In 2025, small to mid-sized nonprofits confronted an unprecedented convergence of risk: AI-enhanced cybersecurity threats, severe financial instability, and increasingly complex regulatory compliance demands. Organizations with formal scenario planning, technology infrastructure investments, and strategic financial management survived. Those relying on hope rather than systematic risk mitigation closed their doors. This analysis presents operational lessons and evidence-based strategies from two decades of executive-level nonprofit leadership.

Essential Requirements for Small to Mid-Sized Nonprofit Survival in Multi-Risk Environments:

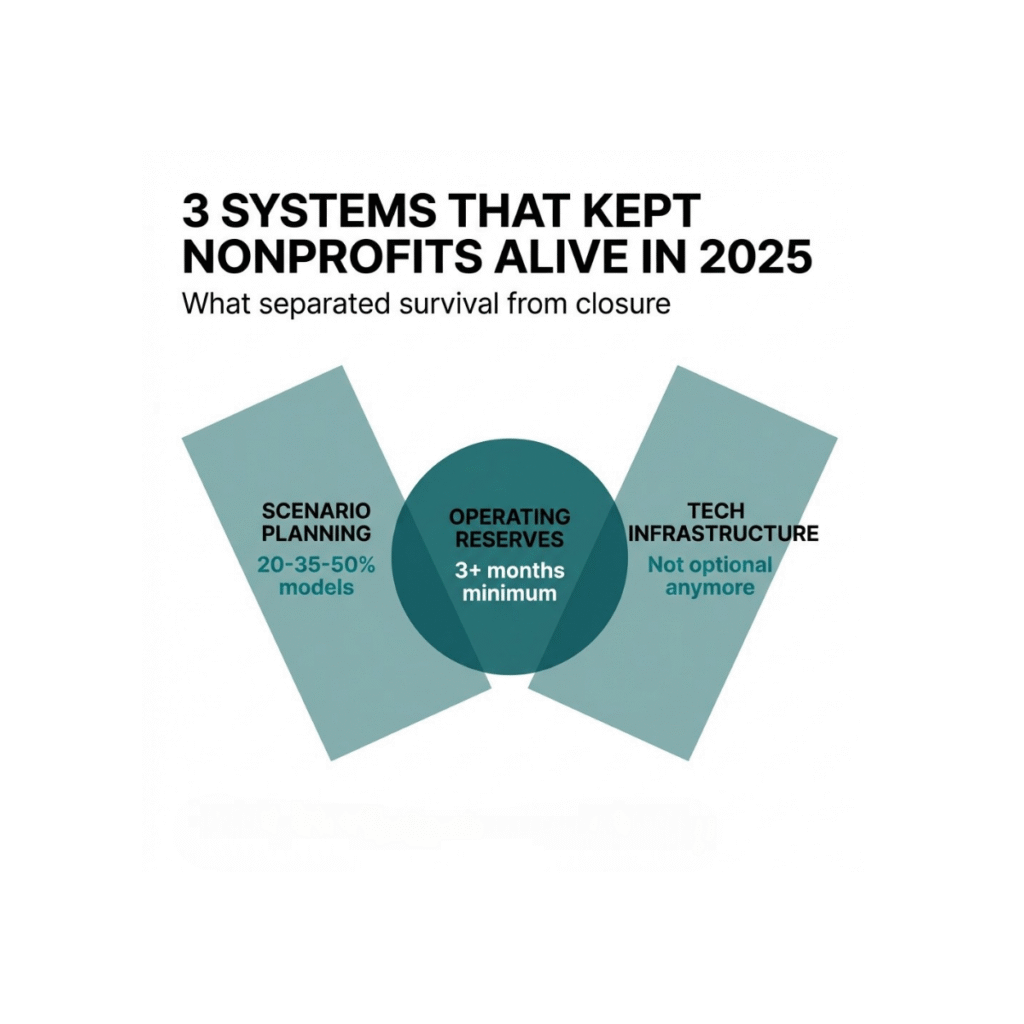

- Formal scenario planning frameworks modeling revenue losses of 20%, 35%, and 50%

- Integrated cybersecurity infrastructure addressing AI-generated phishing and fraud threats

- Operating reserves exceeding three months to absorb funding delays and revenue volatility

- Technology investments in forecasting tools, data analytics, and compliance management systems

- Strategic workforce retention programs addressing the 30% cost burden of nonprofit sector turnover

What Is the Current Risk Environment for Nonprofits?

Throughout 2025, I observed operational patterns across nonprofit organizations facing unprecedented challenges. After two decades of senior executive experience managing multi-million dollar budgets in the nonprofit sector, this year presented conditions I had not previously encountered.

Organizations that demonstrated resilience during the pandemic, adapted financial models to address inflation, and maintained donor relationships through economic uncertainty confronted a qualitatively different threat environment: the simultaneous convergence of cybersecurity vulnerabilities, financial instability, and regulatory complexity.

Quantitative data provides context. About a third of nonprofits lost government funding. Individual donations declined 3.4% between 2022 and 2023, extending a multi-year contraction trend. Donor retention rates decreased an additional 2.5% during this period.

These statistics represent organizational realities I witnessed directly in strategic planning sessions and financial assessments throughout the year.

The Bottom Line: Nonprofit organizations in 2025 faced not isolated challenges, but rather an integrated risk environment requiring systematic mitigation strategies across financial, operational, and technological domains.

How Are AI-Enhanced Cyber Threats Targeting Nonprofit Organizations?

In January 2025, a mid-sized health nonprofit operating with a $4.2 million annual budget discovered its email system had been compromised for three weeks. The attackers deployed AI-generated phishing communications sufficiently sophisticated to bypass detection by IT-trained personnel.

This organization represented a broader pattern. According to the Nonprofit Tech for Good Report, 27% of nonprofit organizations worldwide experienced successful cyberattacks in 2025. Attack vectors specifically targeted entities with legacy security infrastructure and resource-constrained defense capabilities.

The technological environment shifted measurably this year. Cybercriminals deployed AI-based platforms including WormGPT and EvilGPT, marketed through Dark Web channels. These tools generated contextually appropriate phishing communications, produced deepfake video content of executive directors, and replicated board member voices through cloning technology.

One finance director transferred $85,000 to a fraudulent account following a voice call that replicated her CEO’s speech patterns, intonation, and vocabulary with sufficient accuracy to bypass verification protocols. She followed established authorization procedures. The voice synthesis technology achieved near-perfect replication.

Organizations operating with fewer than 100 employees demonstrated the highest vulnerability profiles. Internal fraud cases in nonprofit organizations generated median losses of $85,000 for religious, charitable, and social service entities. The most prevalent fraud mechanisms included corruption schemes (44%), billing fraud (31%), and check tampering (23%).

Key Insight: AI-enhanced cyber threats in 2025 exploited the resource constraints and limited security infrastructure characteristic of small to mid-sized nonprofit organizations, requiring strategic investments in cybersecurity as operational infrastructure rather than discretionary expenditure.

What Financial Instability Patterns Emerged in 2025?

By mid-2025, a consistent pattern emerged in strategic planning engagements with nonprofit executive directors. Financial models constructed during previous planning cycles no longer generated viable operational outcomes.

Data confirms this observation. 55% of nonprofit leaders entering 2025 identified financial instability as their primary organizational concern. Among this cohort, 92% expressed specific concern regarding revenue uncertainty.

The American Rescue Plan Act funding streams concluded. Federal agency budget reductions created cascading effects through state and municipal grant programs. Donor organizations increasingly required comprehensive impact documentation and outcome measurement data before authorizing funding renewals.

I conducted a financial assessment for a youth education nonprofit in Louisiana operating with a $3.2 million annual budget. The organization maintained operating reserves sufficient for six weeks of standard operations. A single delayed government reimbursement would have necessitated immediate workforce reductions.

This reserve position was not anomalous. Research from the Urban Institute’s Nonprofit Operating Reserves Initiative documents that numerous small to mid-sized organizations maintain operating reserves below the three-month threshold recommended for financial resilience.

Organizations demonstrating survival capacity implemented strategic adjustments. According to BDO’s 2024 Nonprofit Standards report, 57% of nonprofit organizations identified funding diversification as their highest strategic priority. These entities explored earned income program models, corporate partnership structures, and donor-advised fund engagement strategies.

Strategic diversification requires implementation timelines measured in quarters, not weeks. The compressed timeline of 2025’s financial environment did not accommodate gradual adjustment strategies.

Key Insight: Financial instability in 2025 stemmed from the confluence of depleted emergency funding streams, reduced government appropriations, and elevated donor accountability expectations, requiring organizations to maintain substantial operating reserves and diversified revenue portfolios.

How Did Regulatory Compliance Demands Escalate in 2025?

Oregon and Delaware enacted enhanced privacy protection standards in 2025. The Office of Management and Budget released revised cybersecurity guidelines under Section 200.303 of 2 CFR, substantially expanding required security controls for organizations receiving federal funding.

Noncompliance consequences extended beyond legal liability exposure. Organizations failing to meet these requirements jeopardized their eligibility for federal funding programs entirely.

I observed organizations attempting to interpret regulatory frameworks designed for enterprise-scale entities with dedicated compliance departments. One public health nonprofit allocated $40,000 to legal consultations for HIPAA compliance interpretation under the revised regulatory framework. This expenditure represented approximately 5% of their annual operating budget.

The regulatory complexity framework did not account for organizational capacity constraints. Small to mid-sized nonprofit organizations operate with limited personnel fulfilling multiple functional roles. Executive directors managing human resources, overseeing information technology infrastructure, and developing grant proposals now required expertise in regulatory compliance frameworks across cybersecurity, privacy protection, and sector-specific requirements.

Key Insight: The 2025 regulatory environment imposed enterprise-level compliance requirements on resource-constrained organizations lacking dedicated compliance personnel, creating substantial financial and operational burdens disproportionate to organizational capacity.

What Strategies Enabled Nonprofit Organizations to Thrive in 2025?

Organizations that thrived in 2025 demonstrated operational resilience that extended beyond survival to position themselves for program expansion and enhanced mission impact.

Formal Scenario Planning Frameworks

According to the Nonprofit Finance Fund, only 34% of nonprofit organizations maintain formal scenario planning frameworks. The organizations demonstrating resilience in 2025 modeled revenue contraction scenarios of 20%, 35%, and 50%. They conducted stress testing of budget models against increased program demand projections. They identified which programs demonstrated scalability potential and which required temporary suspension during financial constraint periods.

When funding reductions materialized, these organizations implemented operational adjustments within days rather than requiring months for strategic response development.

Strategic Value: Formal scenario planning enables rapid operational adjustment to changing financial conditions, reducing organizational vulnerability to funding volatility.

Strategic Workforce Investment Despite Budget Constraints

The nonprofit sector employs 10% of the private workforce. Nearly half of nonprofit employees earn compensation below the ALICE threshold, defined as the income level insufficient to meet basic needs despite full-time employment status. Employee turnover generates costs representing 30% or more in additional operational expenses.

Organizations demonstrating workforce retention success in 2025 did not uniformly offer higher compensation levels. They established transparent career progression pathways, allocated resources to professional development programs, and cultivated organizational cultures emphasizing mission alignment and individual contribution value.

Strategic Value: Workforce retention strategies addressing professional development and organizational culture reduce the substantial cost burden of employee turnover in resource-constrained environments.

Technology Integration as Operational Infrastructure

Organizations integrating technology as core operational infrastructure rather than discretionary expenditure demonstrated superior adaptation capacity. Advanced financial forecasting tools enabled real-time modeling of multiple funding scenarios. Data analytics platforms generated the comprehensive impact documentation increasingly required by donor organizations. Cybersecurity infrastructure investments protected both organizational data assets and institutional reputation.

Organizations treating technology adoption as optional confronted substantial operational challenges. Organizations integrating technology systematically into operational processes adapted more rapidly to changing environmental conditions.

Strategic Value: Technology infrastructure investments enhance forecasting accuracy, donor reporting capabilities, and risk mitigation effectiveness across cybersecurity and operational domains.

What Organizational Characteristics Distinguish Resilient Nonprofits?

Organizations demonstrating resilience maintain comprehensive vision frameworks for 10-year strategic horizons while developing detailed operational roadmaps for 18-month implementation periods. They practice what organizational researchers term “strategic patience,” defined as the capacity to implement short-term operational adjustments without abandoning long-term strategic objectives.

These organizations establish collaborative resilience networks, sharing resources and specialized knowledge with peer organizations facing similar operational challenges. They innovate within resource constraints rather than deferring strategic initiatives pending optimal environmental conditions.

The organizations that ceased operations in 2025 were not characterized by diminished mission commitment, reduced stakeholder dedication, or decreased community need for their services.

They exhausted financial and operational capacity before completing necessary adaptation processes.

Key Insight: Organizational resilience stems from the integration of long-term strategic vision with short-term operational flexibility, supported by collaborative networks and innovation capacity within resource constraints.

What Are the Primary Lessons from 2025’s Nonprofit Risk Environment?

Risk management does not function as a mechanism for eliminating uncertainty. Rather, risk management builds organizational capacity to respond effectively when uncertainty materializes into operational reality.

The nonprofit organizations demonstrating sustained operational success in 2025 did not predict every challenge with precision. They constructed operational systems with sufficient flexibility to absorb external shocks. They developed leadership teams with the expertise and decisional authority to implement strategic adjustments rapidly.

These organizations recognized that financial sustainability, operational efficiency, and enterprise risk management do not constitute separate strategic initiatives. These domains represent interconnected elements of comprehensive organizational health, requiring integrated management approaches rather than siloed functional strategies.

Organizations demonstrating resilience understood that engaging external expertise represents a strategic decision rather than an indicator of organizational weakness. Strategic consulting relationships provide access to specialized knowledge, best-practice frameworks, and objective analytical perspectives that enhance internal decision-making capacity.

The 2025 risk environment differentiated organizations implementing systematic planning frameworks from organizations relying on optimistic projections without contingency strategies. Organizations with formal planning processes continue serving their communities and advancing their mission objectives.

Organizations without systematic planning frameworks experienced leadership transitions as their operational capacity became unsustainable.

Key Insight: Organizational survival in complex risk environments requires integrated management of financial, operational, and risk domains, supported by flexible systems, capable leadership, and strategic engagement of external expertise when specialized knowledge gaps exist.

Frequently Asked Questions

What is the most important factor for nonprofit survival in volatile funding environments?

Maintaining operating reserves exceeding three months of standard operations represents the most critical financial resilience factor. Organizations with adequate reserves absorb funding delays, revenue volatility, and unexpected expenses without triggering immediate crisis responses or workforce reductions.

How much should small nonprofits invest in cybersecurity?

Cybersecurity investment should constitute operational infrastructure rather than discretionary expenditure. Organizations receiving federal funding must comply with OMB cybersecurity guidelines under Section 200.303 of 2 CFR. Minimum investments should include email security systems, multi-factor authentication, regular security training for personnel, and incident response protocols. Organizations handling sensitive health or personal data require additional HIPAA-compliant security measures.

What is scenario planning and why do nonprofits need it?

Scenario planning involves modeling organizational responses to multiple potential future conditions, typically including revenue contraction scenarios of varying severity (20%, 35%, and 50% reductions). This framework enables leadership teams to develop contingency strategies before financial stress materializes, reducing response time from months to days when funding changes occur.

How do nonprofits diversify revenue when grant funding declines?

Revenue diversification strategies include developing earned income program models, establishing corporate partnership structures, engaging donor-advised funds, implementing individual donor cultivation programs, and exploring social enterprise opportunities aligned with mission objectives. Diversification requires implementation timelines of 12 to 18 months and should begin before existing funding streams show decline indicators.

What workforce retention strategies work for nonprofits with limited salary budgets?

Effective retention strategies for budget-constrained organizations include establishing transparent career progression pathways, allocating resources to professional development and training programs, cultivating organizational cultures emphasizing mission impact and individual contribution value, offering flexible work arrangements, and creating leadership development opportunities for high-performing employees.

Should nonprofits use AI tools for operations and risk management?

AI-enhanced tools provide measurable value for financial forecasting, data analytics, donor reporting, and risk identification when implemented within a human-in-the-loop framework. This approach ensures AI-generated insights receive validation, contextual interpretation, and ethical oversight from experienced personnel before informing strategic decisions. AI tools should augment rather than replace human expertise and judgment.

What regulatory compliance requirements increased most significantly in 2025?

Cybersecurity requirements under revised OMB guidelines (Section 200.303 of 2 CFR) and enhanced state-level privacy protection standards in Oregon and Delaware represented the most substantial compliance escalations. Organizations receiving federal funding or operating in multiple states should conduct compliance assessments to identify gap areas requiring remediation.

When should nonprofits engage external consultants?

Organizations should engage specialized consultants when internal expertise gaps exist in domains critical to organizational sustainability, when objective external perspectives would enhance strategic decision-making, when rapid capability development is required in specialized areas (cybersecurity, compliance, financial management), or when leadership capacity constraints limit the organization’s ability to address complex challenges while maintaining standard operations.

Key Takeaways

- Nonprofit organizations in 2025 confronted an integrated risk environment combining AI-enhanced cybersecurity threats, severe financial instability, and escalating regulatory complexity, requiring systematic rather than isolated mitigation approaches.

- Organizations maintaining formal scenario planning frameworks modeling revenue contractions of 20%, 35%, and 50% demonstrated superior adaptation capacity, implementing operational adjustments within days rather than months when funding volatility materialized.

- Operating reserves below three months represent a critical vulnerability factor. Organizations with six weeks or less of reserves face immediate crisis conditions when government reimbursements delay or funding streams conclude unexpectedly.

- AI-enhanced cyber threats exploit resource constraints characteristic of small to mid-sized nonprofits, requiring strategic investments in cybersecurity as operational infrastructure rather than discretionary expenditure to maintain data protection and institutional reputation.

- Workforce retention strategies emphasizing career pathways, professional development, and mission-aligned culture reduce the 30% cost burden of employee turnover more effectively than compensation increases alone in budget-constrained environments.

- Technology integration as core operational infrastructure enables real-time financial modeling, comprehensive donor impact reporting, and enhanced risk mitigation, providing competitive advantages to organizations treating technology systematically rather than optionally.

- Organizational resilience requires integration of long-term strategic vision with short-term operational flexibility, supported by collaborative networks, innovation capacity within constraints, and strategic engagement of external expertise when specialized knowledge gaps exist.